Welcome to mitrobe network review section, In today’s guide, I will be reviewing Piggyvest vertically and horizontally as well as affirming based on certain metrics or statistical data if piggyvest is a legit or fraudulent save and earn investment site.

How to Save And Make Money On Piggyvest In 2020

Previously regarded as Piggy Bank, PiggyVest is a savings-cum-investment service established in 2016. Besides guaranteeing people a secure avenue for saving their funds, PiggyVest comes with a reliable mobile app and offers excellent investment opportunities.

Favourably, this article has been designed to help you learn more about PiggyVest particularly with respect to how its investments work and the key investment features the service offers.

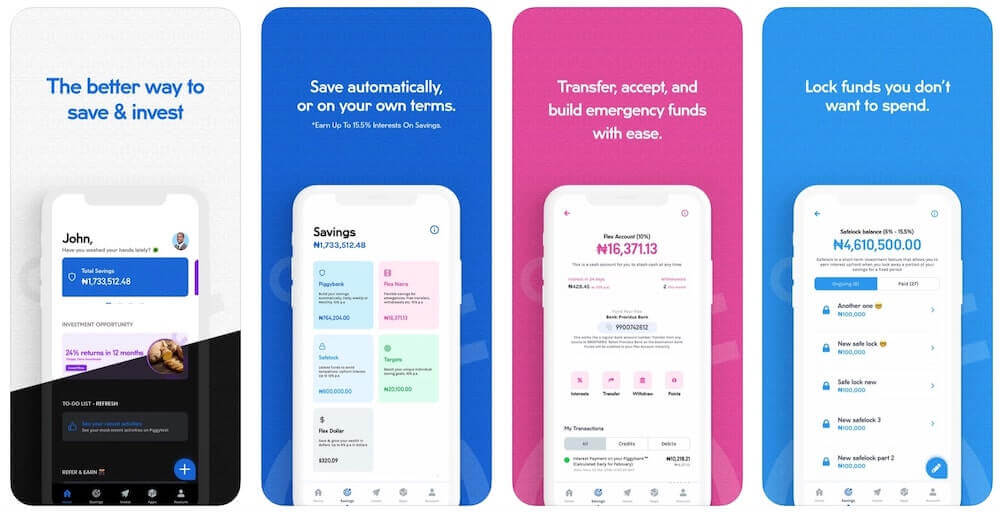

PiggyVest App

The PiggyVest app is currently available on both Android and iOS, and is very trust-worthy. It requires no deposit or monthly fees, and the interface of both the web and mobile applications are user-friendly. Interestingly,Saving with PiggyVest is not just safe and secure, but it also disciplines you by providing you the privilege of locking your funds until a specific or designated release date.

What You Should Know about PiggyVest Investments

To understand how PiggyVest investments work, you need a clear grasp of Investify which is described as PiggyVest’s investment nucleus. While its associated investments are commonly in the areas of transportation, real estate and agriculture, Investify avails you access to primary and secondary investment opportunities.

This way, you’re able to rake in more earnings on your saved funds.

Is Piggyvest Legit or Scam?

Absolutely everyone will like to know if Piggyvest save, lock and earn site is a scam. But in confidence, Piggybank is completely and 100% legit. To affirm the authenticity or veracity of this information, we made a visit to trustpilot to see few of the reviews from customers who have been using piggyvest over the years since its inception, the result was legit all the way. Some even insisted on saying things like “I prefer Piggyvest to traditional bank”. Take a look at the screenshot below from some of the verified customers;

The 5 Key (Investment) Features of PiggyVest

Piggybank –This serves as PiggyVest’s major online savings feature as it enables you to withdraw any amount of money from your local bank account at any given time and save in your Piggybank wallet.

Depending on whether you prefer saving daily, weekly or monthly, Piggybank’s “autosave” support helps withdraw money from your bank account so that such money is automatically deposited in Piggybank. With Piggybank, you’re guaranteed a yearly interest rate of 10% on your savings.

Targets –This is a self-explaining PiggyVest feature that enables you to deposit funds ahead of a future target such as payment of school fees, house rent and so on. In addition to its implication as a specialized feature for target-based savings, Targets is well suited for group savings by which each group member maintains a daily payment frequency.

At the same time, each group in Targets will be tied to a given date for (savings) maturity and is required to have saved a particular amount of money by then. While Targets guarantees a yearly interest rate of 10%, one can reckon that it is a suitable investment option for people tied to a common goal to pool efforts together.

Safelock –This, probably, is an investment option that facilitates financial discipline as you’re not permitted to withdraw any “safelocked” money until the maturity period stipulated by you.

In a simpler sense, PiggyVest’s Safelock is an investment plan that lets you save your money for a given (maturity) period so that you don’t withdraw that money until the stipulated period. One advantageous thing about Safelock is that the interest rate is paid upfront and the yearly interest rate ranges between 6% and 15% of the amount saved.

Flex Dollar –This PiggyVest feature is suitable for dollar-specific savings, investment and fund transfer. In other words, Flex Dollar is specialized for carrying out transactions in dollars and importantly, the applicable interest rates (on savings) vary depending on market conditions.

Flex Naira –This happens to be the repository for the deposit of all the interests you reel in from the other PiggyVest investment features.

In a simpler term, Flex Naira acts as a wallet into which your interests from Flex Dollar, Targets, Safelock and Piggybank are saved. Notably, Flex Naira guarantees a yearly interest rate of 10% and while using this investment feature, you should note that you’re not allowed to make more than four withdrawals and only one withdrawal is permitted every 10 hours.

About the PiggyVest App

PiggyVest maintains a mobile application which can be accessed on both iOS and Android device platforms. Quite interestingly, users of the app are not obliged to pay any monthly fee.

How to Register on PiggyVest and Start Saving

Now it’s to register on piggyvest and start enjoying piggyvest features.

- Visit PiggyVest Website using this link Piggyvest Create Account

- Click on create an account after clicking the link above.

- Fill the information and submit.

Do not download the app if you haven’t created an account with the link above.

- Now download piggyvestMobile App from play store or using this link here.

- Log into your profile.

- Now you can start saving and make money by referring to people also.

Note: If you don’t register with the link above you will miss getting an N1000 bonus, also complete setting up your account in other to start making money from piggyvest while saving.

Interest Rates on PiggyVest

The different interest rates available on PiggyVest are:

- 10% per annum on Piggybank

- Up to 15.5% per annum on SafeLock

- 10% per annum on Target

- 10% per annum on Flex

- 6% per annum on Flex Dollar

- Up to 25% on Investify

♦To learn how to start making money with PIggyvest,click here

♦To start saving and earning money massively with Piggyvest click here immediately

Conclusion

Needless to say, PiggyVest is a trusted service that helps people better manage their financial lives as well as tap into investment opportunities that eventually bring about financial success.