OPAY LOGIN –HOW TO OPEN AN OPAY ACCOUNT AND LOGIN TO OPAY APP ACCOUNT

OPay is an Africa-focused payment service owned by Opera. The popular payment service, which came into being in 2018, is vastly popular in Nigeria with Lagos being the epicenter of its activities.

Fully pronounced as Opera Payment, OPay is a widely used payment service across several Nigerian cities including Ibadan, Aba, Kano and Enugu.

If you’ve learned one or two things about OPay and its services, you may want to sign up for the payment service. In that case, this post covers most of the things you may want to know about OPay. The post particularly sheds light on how to open an OPay account as well as how you can fund the account or withdraw funds from it.

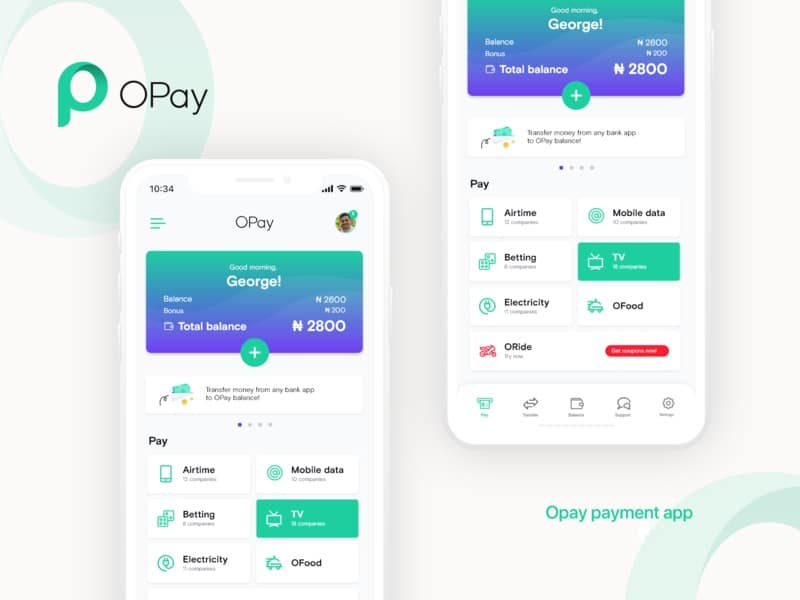

Functionality of the OPay App –Things You Can Do with the App

The popular OPay app –downloadable from Google Play Store –is useful for a number of purposes. Besides its common use for fund transfer, other uses of the app include:

- Making an order for food

- Access to OWealth investment

- Funding your betting account

- Access to OLeads which is a resource for creating a website in no time

- Access to OKash which is an avenue for obtaining short-term loans

- Using QR (code scanning method) for transferring and receiving funds

- Access to any of OPay’s riding services

- Subscription to Pay TV

- Purchase of airtime and internet data bundles

- Payment of electricity bill

- Product listing

How to Open an OPay Account

- Head to Google Play Store on your Android phone

- Enter the search bar and input “OPay app” in it

- Click the app’s icon from the emerging search results

- Download and install the OPay app

- Launch the installed app and sign up for an OPay account

- Ensure you provide all the required credentials for the account creation

Note that OPay will impose a #30,000 account limit as well as the daily transfer limit of #10,000 on you. But you can simply cancel out these limitations by providing the following credentials: government-issued ID, BVN and utility bill.

OPay Login –Steps to Login to Your OPay Account from the Web

- Open the Opera Mini browser on your phone

- Locate the app icon indicating Get Cashback and click it

- The emerging page will display a big Cashback ad

- Simply avoid the ad by scrolling to the top right side of the page and clicking the x cancel sign that you see there

- Navigate to the top left corner of the next page to click the Login in button therein

- At this point, you can enter your OPay-linked phone number as well as your password. If this is your first login attempt via Opera Mini, Opay will want to verify you. You’ll then be sent an OTP either by text or phone call. You may as well dial the USSD code *347*010# in order to generate a text message containing your OTP. Input the 6-digit OTP and see your login go through.

Funding Your OPay Wallet

To load funds into your Opay (wallet) account, you may opt to link your debit card or withdraw the funds from your bank account. If you’d like to fund the account using your debit card, you’ll only have to link your debit card details to the account.

The second option, which seems to be the better way, requires you to use your mobile banking app in transferring funds to the OPay account. In this case, you’ll have to specify Paycom as “bank” and input your OPay-linked mobile number. This, otherwise, is the phone number you submitted at the point of OPay registration. Note that while inputting the (Nigerian) phone number, you don’t need to add the zero (O) that begins the number.

Before you can successfully fund your OPay wallet via the second method above, you have to be sure you’re transferring the funds from a supported bank. Below is a list of the Nigerian banks from which you can directly fund your Opay account:

- Access Bank

- Zenith Bank

- UBA

- Heritage Bank

- Union Bank

- Diamond Bank

- Stanbic IBTC

- FCMB

- Sterling Bank

- Wema Bank

- GTBank

A third funding method is via an Opay agent that you can locate through the Nearby agents option in your Opay app. A click on this option provides you with the details (phone numbers and addresses) of the closest agents to you. This funding method is especially recommendable to those without bank accounts or anyone struggling to access theirs.

How the method works is that you simply deposit your desired funding amount with the Opay agent and then provide your Opay number so that the deposited amount can be transferred to your wallet.

Besides being an alternative for people without bank accounts, this funding method is a cost-free way you can get a trusted Opay staffer to help transfer funds to your wallet.

Sending Funds to Other OPay Users

You may want to transfer funds from your Opay account. If your prospective recipient is an Opay user, you can transfer the funds to their account by clicking the Transfer button in the Opay app. Following that, look under the Send to tab and select OPay. Subsequently, you’ll find the input fields for your recipient’s phone number as well as the amount you intend to transfer. After filling those fields, click the Done button to complete the transfer.

Withdrawing Funds from Your OPay Wallet

Just like funding your OPay wallet, withdrawing funds from the wallet can also be done in two ways. You may opt to withdraw the OPay funds into your local bank account or visit a nearby OPay agent.

The second option is especially suitable if you want to directly convert your OPay funds into cash rather than transfer the funds to your bank account. In this case, what the OPay agent does is asking you to transfer your desired withdrawal amount to their OPay number. However, you’ll be charged a service fee for the withdrawal by the OPay agent.

If you prefer to send the OPay funds to your bank account and withdraw from the account, simply click the in-app Transfer button and choose Bank from the Send to tab. Subsequently, provide your account number and your intended transfer amount. Click the Done button after providing the latter details.

Conclusion

We strongly believe that through this post, you have learnt all you were willing to know about OPay. However if you think the post didn’t touch some important areas, you may state them in the comment section below.