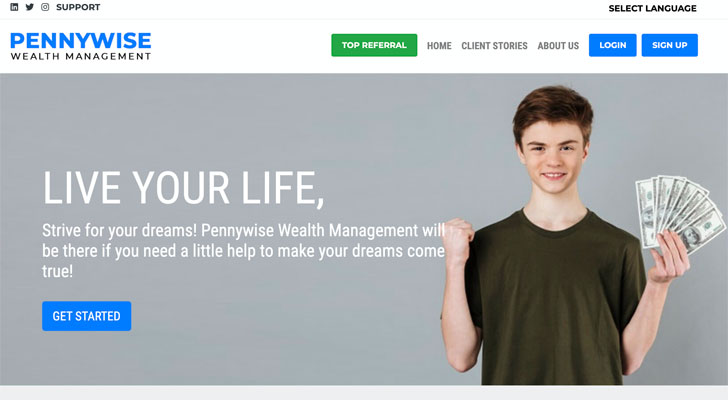

Pennywise Wealth Management Review –Is Pennywise Investment Programme Legit Or A Scam?

Pennywise Wealth Management is an illegal financial venture which adopts a pyramidal membership structure in which old members are paid through the money earned on new members. This operational structure exposes both old and new members to financial risks; in the first sense, the old members are on the losing end when there are no new members and in the second sense, new members are very likely to lose the funds invested.

If you’re still doubtful despite having heard nasty stories about Pennywise Wealth Management being a scam, you should rest assured that in this article, you’ll find out the cogent reasons why Pennywise Wealth Management is no different from a scam.

By and large, Pennywise Wealth Management is termed a Ponzi-like illegal venture because in a similar way to Ponzi schemes, it poses as a company running legit investments and it entices people with unusual returns in order to get money from them. Observably, many people have fallen for this venture’s gimmicks simply because at the initial stage, the investors are paid the profits as claimed. However in reality, the payments to such people (investors) are made from the deposits by newer members/investors.

What are the investment plans like?

Pennywise Wealth Management lets members choose from three different investment plans namely Premium (with a daily return of 2%), Gold (with a daily return of 2.5%) and Platinum (with a daily return of 3%). While $100 stands as the required amount of deposit for the lowest investment plan, the higher plans require the respective deposits of $30,000 and $60,000.

Evidence-Based Reasons to Prove That Pennywise Wealth Management Is a Scam

A lot of questions have been raised about the trustworthiness of Pennywise Wealth Management. You may be confused as to whether Pennywise Wealth Management is actually a scam or the negative reports about the investment scheme are merely intended to soil its image. But with the help of the following factual reasons, you’ll be able to arrive at a cogent conclusion regarding the legit status of Pennywise Wealth Management:

- Pennywise Wealth Management Is Unregulated

Pennywise Wealth Management affects to be a regulated investment company but in reality, it isn’t regulated by any authority. If you browse the website of Pennywise Wealth Management and read through the company’s Terms and Conditions, you’ll observe the claim that the company is located in Great Britain. If it were truly a registered company in Great Britain, it would be regulated by the Financial Conduct Authority. However, Pennywise Wealth Management isn’t regulated by the Financial Conduct Authority, hence giving the impression that it is an illegal enterprise.

- It Illegally Clones an Existing Company

Well-conducted research about Pennywise Wealth Management has revealed that the illegal investment platform directly clones an actual and legal company known as Pennywise Investments. To clarify its dissociation from Pennywise Wealth Management, Pennywise Investments maintains a disclaimer on its website, implying that it bears no tie with the former.

Moreover, it’s been claimed that Pennywise Wealth Management decided to clone Pennywise Investments (which is a real and legal company) in order to trick prospective investors into believing that it is a legit enterprise.

- The Placement of Fake Testimonials on Its Website

It has been confirmed that the testimonials on Pennywise Wealth Management were illegally taken from Pennywise Investments. Perhaps, these testimonials (inclusive of stories and pictures seen on Pennywise Investments) are intended to beguile people into accepting that Pennywise Wealth Management is legit whereas it’s indeed a scam.

Conclusion

With the three evidence-based reasons explained in this article, it’s irrefutably clear that Pennywise Wealth Management is an illegal investment platform. Although there are dozens of legit and beneficial investment schemes out there, Pennywise Wealth Management is considered one of the Ponzi-like schemes you should avoid.