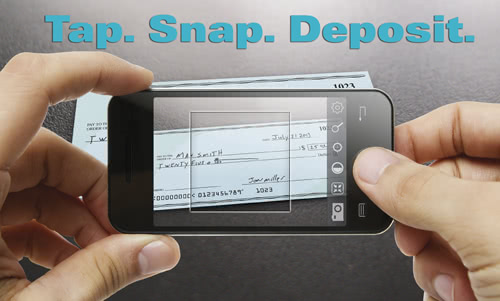

The possibility of depositing checks via smartphones might not be a new subject matter but of course, it is one of the fascinating benefits of mobile banking. Banking customers increasingly desire the easy ways to perform transactions and obviously, mobile check deposit comes to the fore as one great way to avoid the traditional mode of check deposit.

Needless to say, mobile check deposit only requires you to snap the front and back of your hand-held check using the appropriate smartphone app. Also to complete your check deposits via a smartphone, you only need to download a mobile banking app and follow a few steps.

Whereas mobile check deposit comes with interesting benefits such as the convenience of depositing your checks (as you readily know), here are the other things you should know about this method of depositing checks.

Banks Don’t Allow Their Mobile Apps to Save Check Pictures

Because banks understand that you could lose your phone and to save you security threats when a third-party accesses your mobile check deposits, they don’t allow their mobile apps to save any check images. Instead, these images are kept securely with the banks. So, don’t expect your smartphone to be heavily packed with such deposit details as pictures of checks snapped.

Mobile Deposits Don’t Prevent Checks from Bouncing

You shouldn’t think your use of smartphones for check deposits can save you the issue of check bounce. If the funds in the account you’re drawing your check against aren’t adequate, your check is very likely to bounce. Put simply, no funds will be released to you if the stated account isn’t holding sufficient funds plus there isn’t an option for overdraft. This case of rejection, as it applies to mobile banking, is just similar to how a check is likely to be rejected after being deposited via a different method.

There Are Smartphone Apps That Help Capture Accurate Images for Check Deposits

Since check deposits only require you to try a few tricks on your smartphone, you might need a smartphone with a newer OS version for effective mobile check deposits. Endeavor to use the smartphone in downloading some of the latest apps which could guide you on how to position your check for accurate capturing. According to an online review, there are smartphone apps that automatically snap your check once they get the right positioning for the check.

To save yourself some of the hitches associated with mobile check deposits, ensure you aren’t using old-fashioned smartphone apps as some of these apps might fail to identify checks.

You Have to Perform Your Mobile Check Deposit before Your Bank’s Evening Cutoff

Normally, banks specify cutoffs and this means that if you want your funds to be released on the subsequent business day, you have to meet up with your bank’s cutoff. Irrespective of the method of deposit, this is the norm, meaning your bank can delay your mobile deposits if you fail to catch up with its stipulated cutoff.

Banks Can Set Limits to Mobile Check Deposits

Your bank reserves the right to restrict your mobile check deposits. Although banking policies may vary from one bank to another, it should be noted that your bank can impose monthly or daily limits on your mobile check deposits. While this deposit limitation is considered (by banks) a major way of preventing fraudulent transactions like fake bank alerts, you should find out the daily or monthly limit set by your bank.

However if you’re hell bent on going beyond your bank’s limit for mobile check deposits, trying one of the traditional deposit methods might be your only way out.